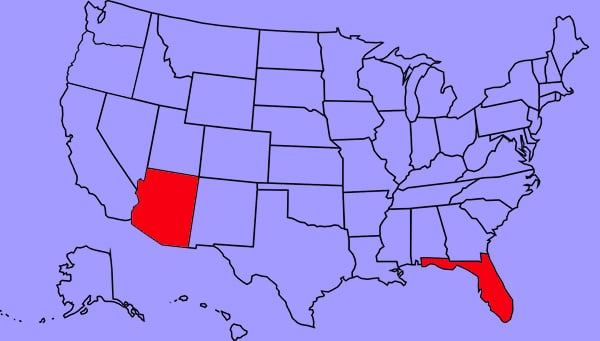

Every year, thousands migrate to Florida and Arizona in pursuit of a fulfilling retirement. The allure of sunny days, scenic landscapes, and retirement-friendly communities beckon many. However, when considering the financial aspects and long-term implications, making an informed decision becomes crucial.

The Appeal of Florida and Arizona

Florida stands out for its beautiful beaches, vibrant lifestyle, and a high influx of retirees. On the other hand, Arizona boasts stunning desert landscapes, warm climates, and a variety of retirement communities.

Cost of Living

Florida has been witnessing a surge in costs. Real estate prices are skyrocketing, making homeownership increasingly expensive.

Arizona, in contrast, offers relatively reasonable housing costs, making it an attractive option for retirees.

Insurance

Florida faces the constant threat of hurricanes, resulting in mandatory flood insurance, which significantly impacts homeowners’ expenses.

Arizona, with fewer natural calamities, has lower insurance premiums, offering financial relief to homeowners.

Homeowner’s Insurance

In Florida, while homeowner’s insurance is mandatory if there’s a mortgage, cash buyers might forego it, risking severe financial implications in case of property damage.

In Arizona, homeowner’s insurance is comparatively affordable, ensuring protection without excessive financial burden.

Post-Disaster Management

After a hurricane in Florida, dealing with insurance claims becomes complex. Delayed repairs due to busy contractors and mold issues can exacerbate the situation.

In Arizona, the impact of natural disasters, such as wildfires or monsoons, is relatively minimal, making property management post-disaster less cumbersome.

Condominium Fees

High-rise condominiums in Florida are experiencing exorbitant fee hikes due to various factors, potentially straining retirees’ finances.

Arizona presents a more stable scenario with reasonable fees, ensuring financial predictability for retirees.

Key Takeaways

- Florida is grappling with escalating costs, insurance complexities, and rising condo fees, posing significant financial risks for retirees.

- Arizona emerges as a more financially viable option, offering a balance between affordable living and a favorable climate for retirement.

- Making an Informed Decision

- While both states have their allure, understanding the financial implications is crucial for a secure retirement. Considering the rising costs and potential financial pitfalls in Florida, exploring Arizona as an alternative becomes prudent.

Ultimately, your retirement destination should align with your financial goals and lifestyle preferences. While Florida’s charm is undeniable, the financial realities indicate the importance of considering alternatives like Arizona for a more secure and sustainable retirement.

If you’re thinking about a move or seeking more insights into the best retirement options, reach out for personalized guidance. Making an informed decision ensures a fulfilling retirement while safeguarding your financial future!