When the journey to homeownership begins, the array of mortgage loan options in Arizona can seem overwhelming. Understanding these choices empowers buyers to navigate their unique paths to property ownership. Let’s delve into the intricacies of these six loan types and their distinctive features.

FHA Home Loans – Ideal for First-Time Buyers

FHA loans, backed by the Federal Housing Administration, serve as a lifeline for first-time buyers and those with moderate incomes. They significantly lower the barriers to entry for homeownership, allowing individuals with lower credit scores and minimal savings to qualify.

These loans typically:

- Enable down payments as low as 3.5% with a credit score as low as 580 (or 500 with a 10% down payment).

- Mandate an upfront mortgage insurance premium (MIP) of 1.75% and an annual MIP ranging from 0.45% to 1.05%.

- Offer flexibility in terms of loan length, fixed or adjustable rates, and down payment options.

Pros:

- Accessibility for those with lower credit scores and limited savings.

- Allowance for down payment gifts and absence of income limits.

- Competitive rates and the unique advantage of assumable mortgages.

Cons:

- Obligation for lasting MIP based on down payment percentages.

- A substantial upfront insurance premium of 1.75%.

- Property usage restrictions and limited fixed loan term options.

Conventional Mortgage Loans

Conventional loans, devoid of government backing, provide a versatile lending option for various buyer profiles. They cater to a wide range of property needs and often offer lower interest rates compared to government-backed mortgages.

Key Aspects:

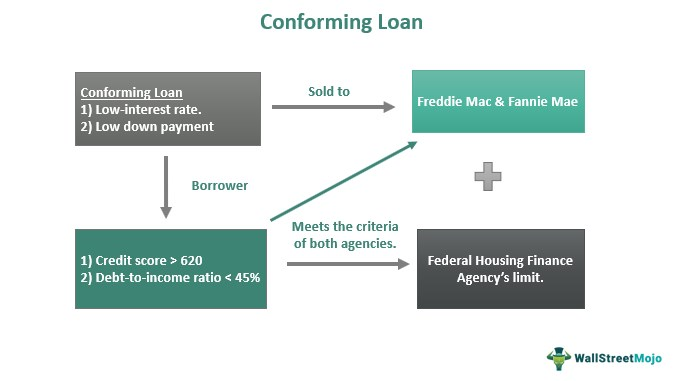

- Purchased by Fannie Mae and Freddie Mac but not directly funded or serviced by them.

- Typically require a minimum credit score of 620 for conforming loans and evidence of consistent income.

- This may necessitate private mortgage insurance (PMI) for down payments below 20%.

Pros:

- Flexibility in property choices and refinancing options.

- Diverse loan terms, offering both fixed and adjustable rates.

- Generally lower interest rates compared to government-backed loans.

Cons:

- Stricter approval criteria, such as higher credit score requirements.

- Possible need for PMI with down payments less than 20%.

Conforming Mortgage Loans

Conforming loans adhere to specific criteria outlined by Fannie Mae or Freddie Mac concerning loan size, credit scores, and debt-to-income ratios. Meeting these standards allows these loans to be sold in the secondary mortgage market.

Nonconforming Mortgage Loans

Nonconforming loans surpass conforming loan limits and aren’t bought or guaranteed by Fannie Mae or Freddie Mac. Jumbo loans are a prevalent example of nonconforming mortgages, catering to high-value property purchases.

VA Loans (Veterans Affairs Loans)

Exclusive to veterans, active service members, or their surviving spouses, VA loans require no down payment or private mortgage insurance. However, they do have a one-time funding fee, which can be included in the loan.

USDA Loans (U.S. Department of Agriculture Loans)

Designed for low-to-moderate-income buyers in rural areas, USDA loans offer zero-down financing with low-interest rates. They don’t mandate a minimum credit score but do come with income and geographical limitations.

Understanding these diverse loan options is pivotal in making an informed decision. Your ideal lender should not only comprehend these loan types but also possess a firm grasp of Arizona’s housing market, guiding you toward homeownership with confidence and clarity.